|

Protection against... |

Detection... |

Ease to install |

User usage

(green=easy) |

| |

funds transfert |

simple phishing |

MITM phishing |

ISP pharming |

trojan keylogger |

advanced trojan |

before-fraud |

after-fraud |

| |

|

|

|

|

|

|

N/A |

N/A |

|

|

Goal : ensure bank deals with the real customer and reciprocally

Installed by : business lines

Here is the only solution where you won't find an associated home made tool. Indeed, a working two factor authentication solution will require a huge improvement of your system (unless you consider phone as a proof of authentication. In this case, have a look at SMSA tool).

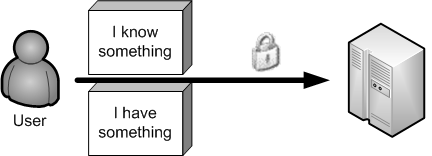

Required by the FFIEC, the two-factor authentication — e.g.

'something you know', 'something you have' or 'something you are'

— is increasingly used and deployed. It is often used as the

'something you know' / 'something you have' couple to authenticate

users. However, it is required that the proof of factor does not travel

over the same channel, as if it does, attacks are still possible.

What is really important, is to perform mutual authentication. A user

has to be confident about the identity of the bank in order to prevent

him from giving away his credentials to a malicious Web site. In turn,

the bank has also to be confident about the identity of its customer,

to prevent from making a money transfer on a malicious account.

This mutual authentication can be established when two differents

channels are used to exchange information between a bank and its

customer.

We already presented a SMS authentication which is a kind of TFA using

two differents channels. Other solutions can also be used to complete

this TFA requirement.

Wikid

is offrering an interesting solution using a software client token that

uses public key cryptography to ensure the client authentication. This

authentication can be made on a domain basis rule so that it's possible

to login on several area with a single token. What is interesting here,

is that this token has been made available on several platform.

Nevertheless, it might be possible for an advanced trojan to steal the

token private key.

A PKI that would be fully dedicated to user authentication, may also be

interesting. Despite the high cost of this solution, this is a very

interesting way to achieve mutual authentication. The certificate

distribution might also be difficult to manage when dealing with

customers. Furthermore, some advanced trojans or rootkit might also

might also be able to be steal the private key, or at least hook the

browser SSL library, therefore making the solution useless.

If you're interested in managing your own PKI, have a look at openca. Commercial companies will also be glad to offer their services on this part.

To prevent cryptographic key theft on the local machine, it is possible

— and it may even be the best way — to delegate this

cryptographic function to an external terminal using a smartcard, and

only have API/driver for reading on the local computer. EMV (Europay

Mastercard Visa) defined the interaction at both the physical and the

application levels to allow financial operations. The main issues here

are related to the potential loss of a token, or a customer that may

forget his token somewhere.